Sales Tax Payable

In RunPTO , you have the flexibility to create specific asset and liability accounts for various purposes. For example, you can create accounts for Sales Tax Payable or funds allocated to National or State PTA. This allows you to perform transactions directly with these liability accounts, eliminating the need for workarounds such as pseudo bank accounts or improper placement of funds in the Income Statement.

By utilizing these dedicated accounts, you can accurately track and manage your financial activities without compromising the integrity of your financial statements. This ensures that your funds are appropriately categorized and represented in your financial records.

To properly handle sales tax in your accounting records, you can follow these steps:

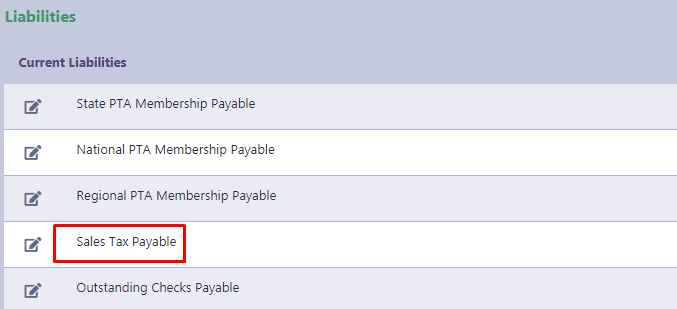

- Create a “Sales Tax Payable” liability account in your chart of accounts. This account will be used to track the amount of sales tax owed.

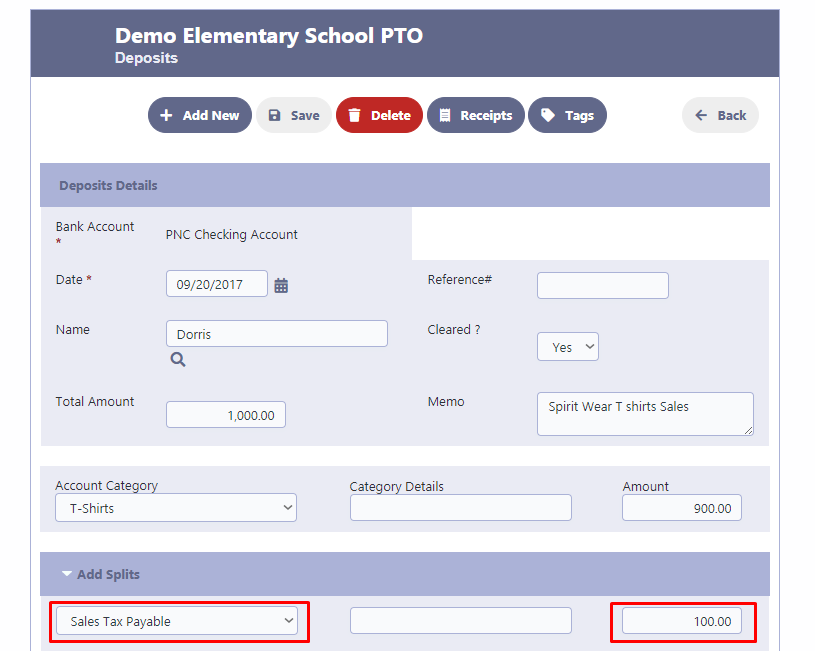

- When creating a deposit transaction, assign the portion of the sales that represents sales tax to the “Sales Tax Payable” account. This ensures that the sales tax amount is correctly recorded and tracked separately.

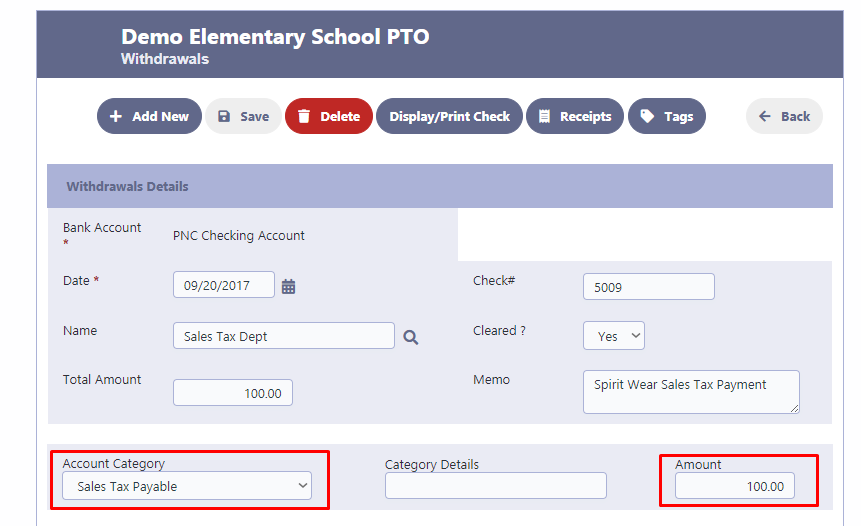

- Whenever a payment is made to the Sales Tax Department to settle the sales tax liability, create a withdrawals transaction. In this transaction, debit the “Sales Tax Payable” account to reduce the outstanding balance and accurately reflect the payment made.