Introduction

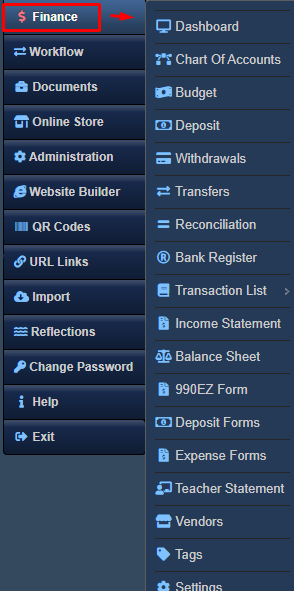

Finance Module

The Finance Module in RunPTO provides comprehensive tools for managing the finances of a PTA/PTO organization. With this module, you can easily perform the following financial activities:

- Set up your Chart of Accounts

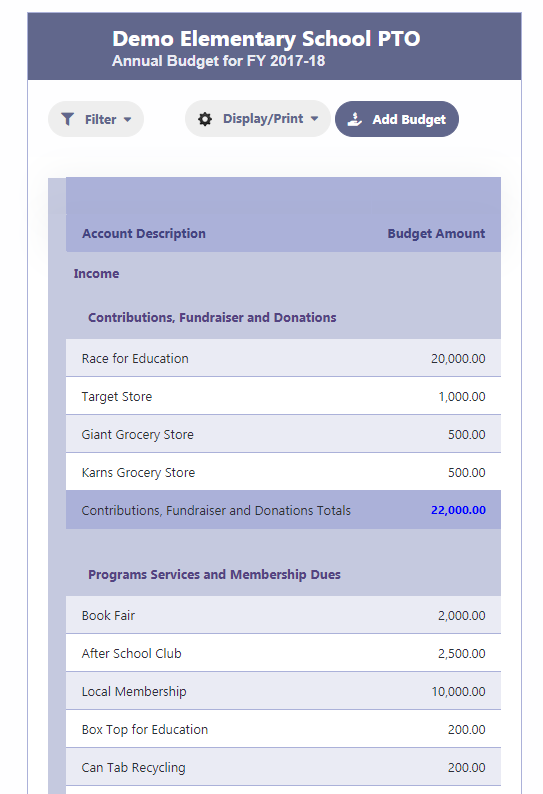

- Establish your Annual Budget

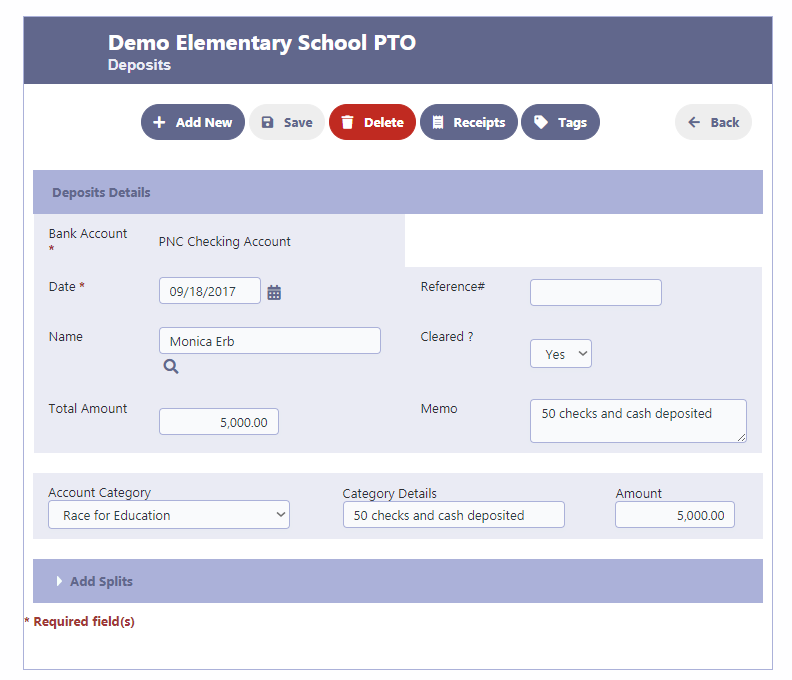

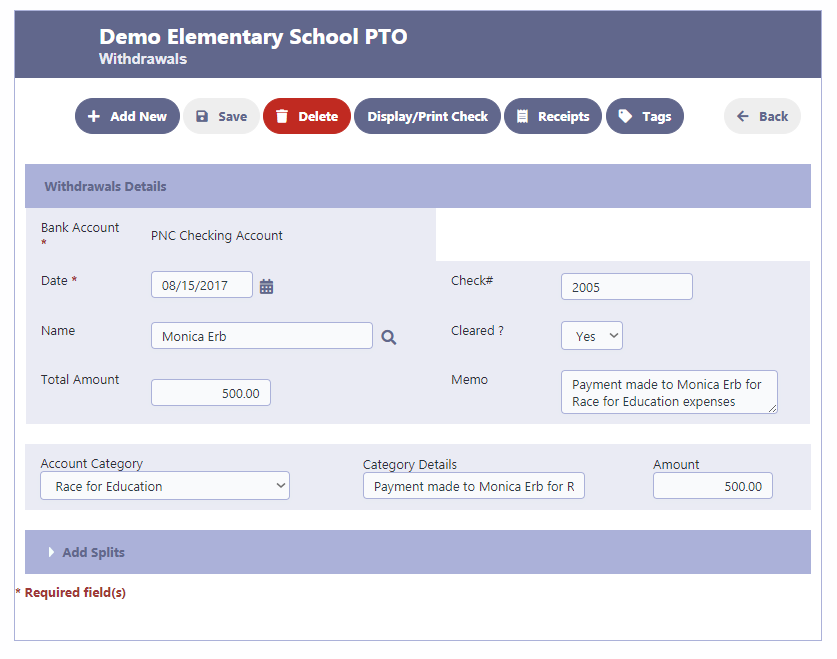

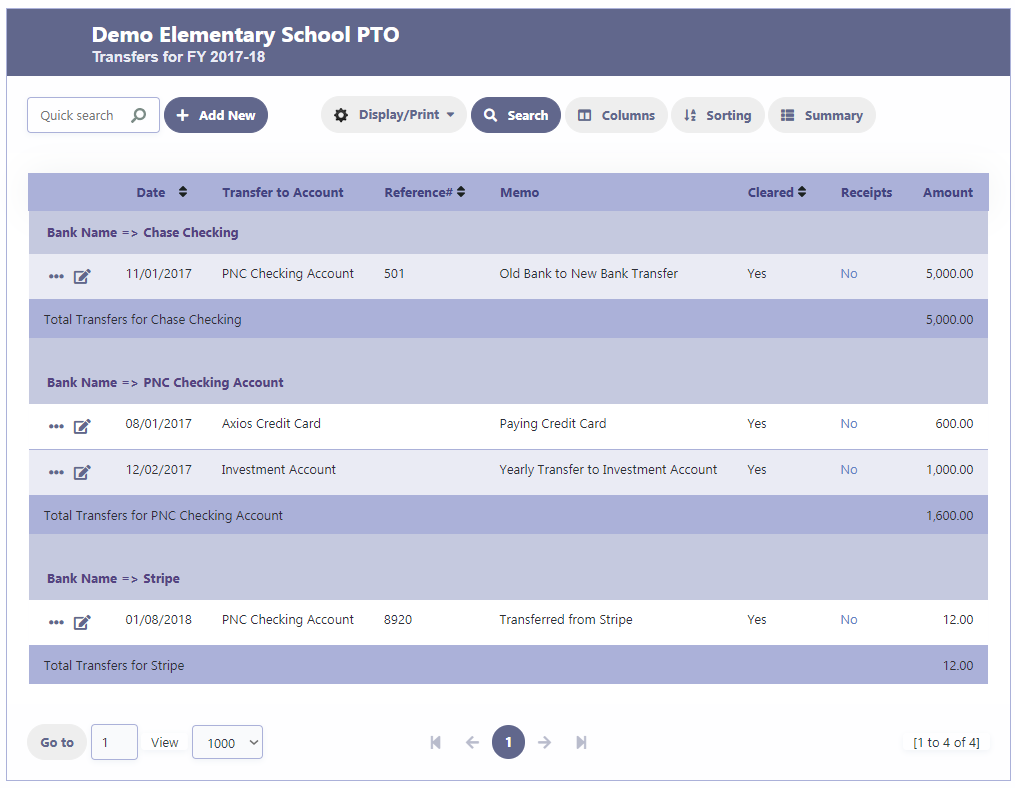

- Record financial transactions such as Deposits, Withdrawals, and Transfers

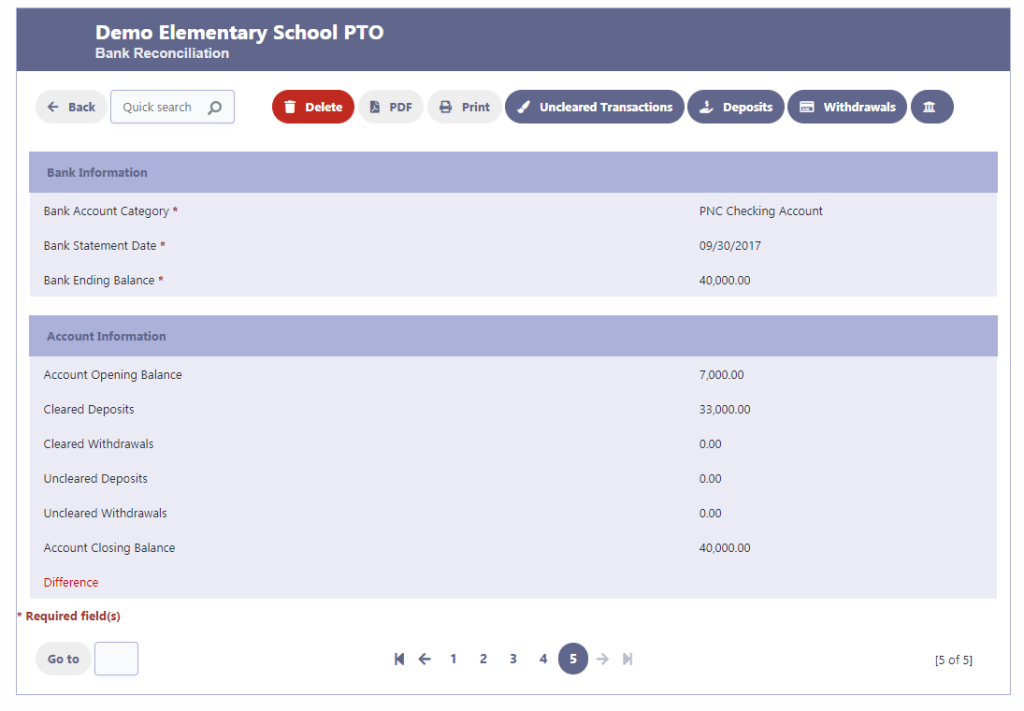

- Conduct Bank Reconciliation

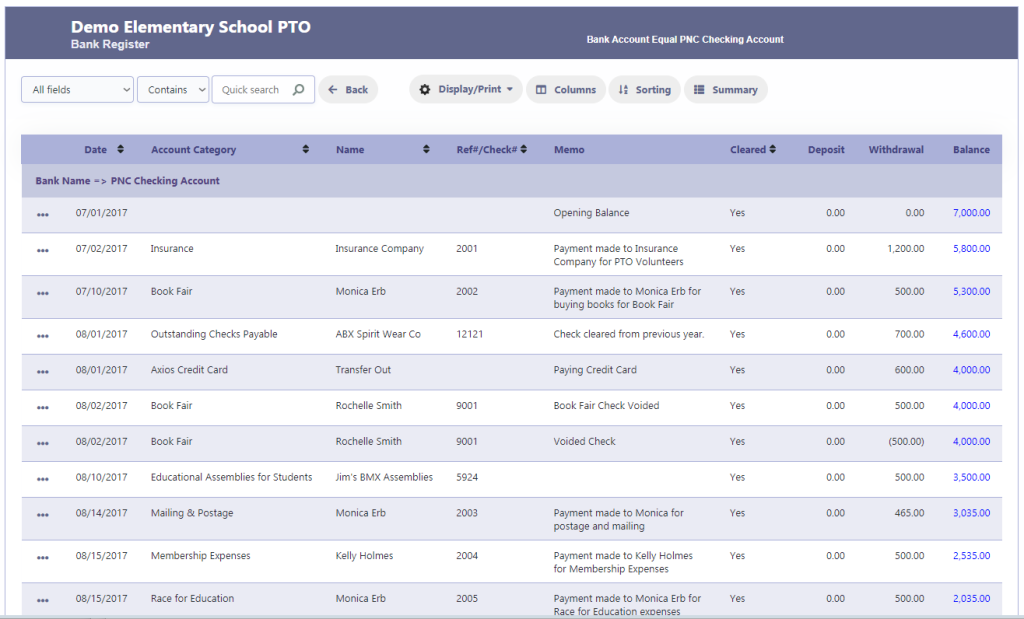

- Display/Print Bank Register

- View/Print Transaction List

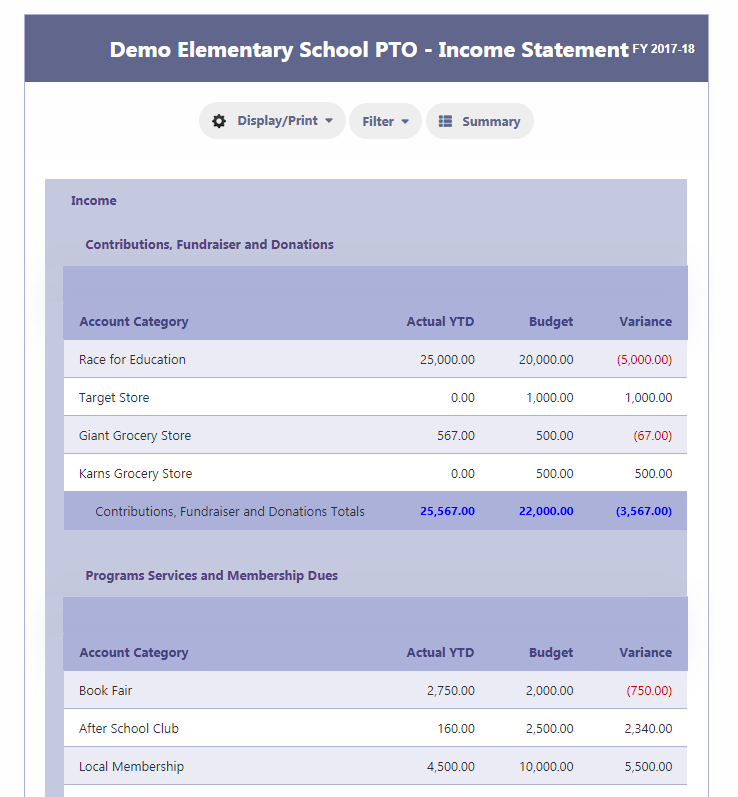

- Generate/Print Income Statement

- Access/Print 990 EZ Form

These features are designed to streamline your financial management processes and provide you with the necessary tools for effective financial oversight.

Key Terms

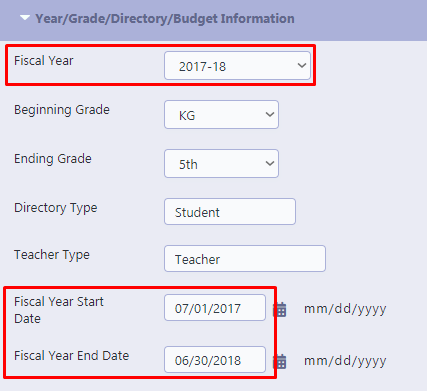

What is a financial year?

A financial year refers to the designated period during which an organization maintains and audits its annual accounts. In the case of a Parent Teacher Organization, the typical financial year spans from July 1st to June 30th of the following year. This defined timeframe allows for proper financial planning, reporting, and assessment of the organization’s activities and resources.

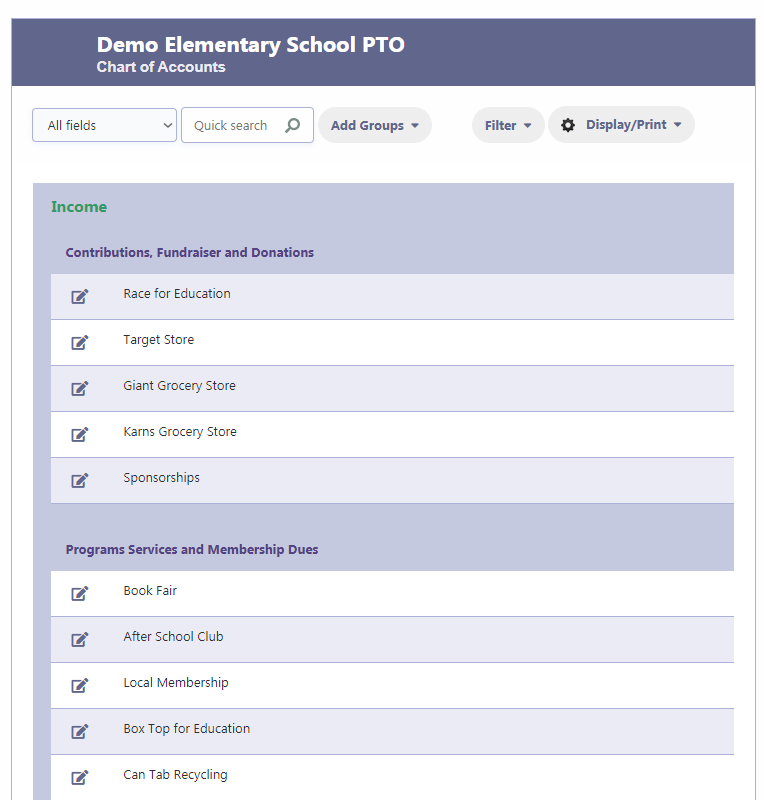

What is a chart of accounts?

A chart of accounts is a comprehensive listing of the various accounts utilized by a Parent Teacher Organization to effectively monitor its income, expenses, assets, and liabilities. It provides a structured framework that categorizes and organizes financial transactions, enabling accurate recording and analysis of the organization’s financial activities. The chart of accounts serves as a valuable tool for tracking and managing the PTO’s financial resources.

What is Budget?

A budget serves as a projected financial plan outlining the expected goals and expenditures for a given financial year. It provides an estimation of how an organization intends to allocate and receive funds over a specific period. By outlining anticipated income and expenses, a budget allows for better financial management and decision-making. It serves as a roadmap for financial planning and guides the organization’s spending and revenue generation throughout the year.

What is debit in accounting?

Debit is a term used to describe the side of an account where monies are deposited.

What is credit in accounting?

Credit is a term used to describe the side of an account where monies are withdrawn.

What are Transfers in Financial Accounting?

Transfers are defined as an transfer of funds from one side of an accounting entity to another.

e.g from the Checking Account to a Savings Account or Investment Account or from a Payment Processor like Stripe or Square to the Checking Account.

What is a Income Statement?

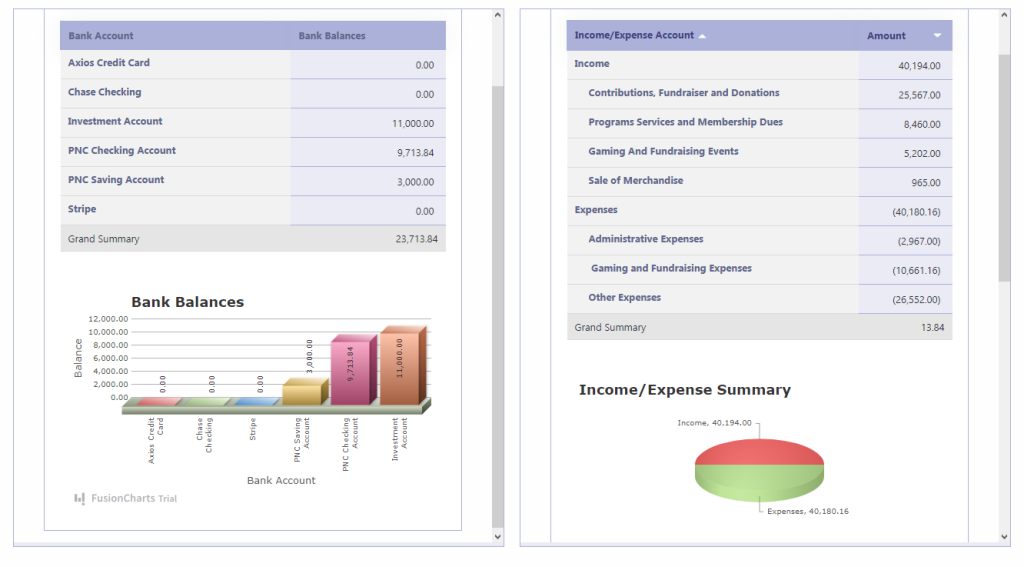

An income statement is a financial statement that reports the revenues, expenses and net income/loss for a organization during the financial year.

What is Bank Reconciliation?

Bank Reconciliation is the process of comparing the balances of a bank statement with the balance as per the books of accounts. It is the process of verification that the balance as per the books of accounts is same as per the bank statement.

What is a Bank Register?

Bank Register is a statement in which the deposits, withdrawals, and balances of each bank account are recorded.

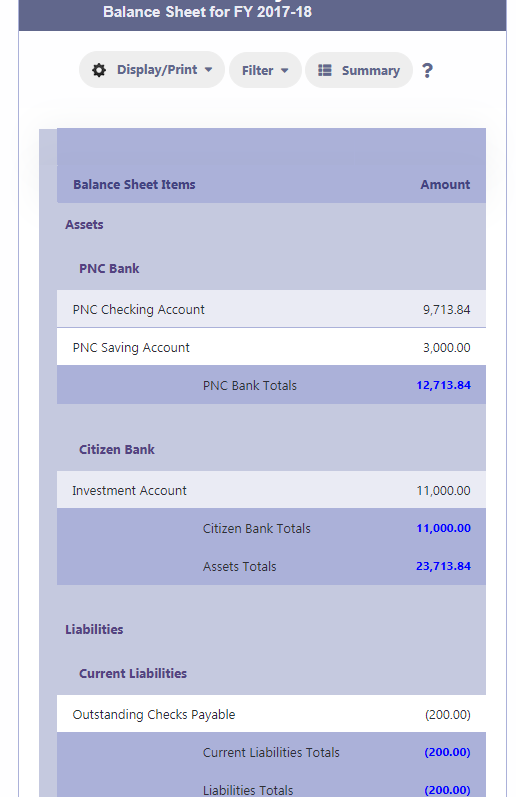

What is a Balance Sheet?

A Balance Sheet is a statement of the assets, liabilities and net worth of your organization. It is a financial statement that summarizes the financial position of your organization at a specific point in time. It is like a personal budget where you add up the income and expenses to determine the net worth of a person.

What is a Financial Dashboard ?

A Financial Dashboard is a single page of charts and numbers that you can see at a glance and use to make decisions. It is a dynamic and ever changing view of your organization finances. This would be your Treasurer’s Report.