990EZ Report

The 990EZ form is a reporting document used by certain tax-exempt organizations in the United States to provide information about their financial activities, governance, and compliance with tax regulations. It is specifically designed for organizations with annual gross receipts below a certain threshold, allowing them to file a simplified version of the Form 990.

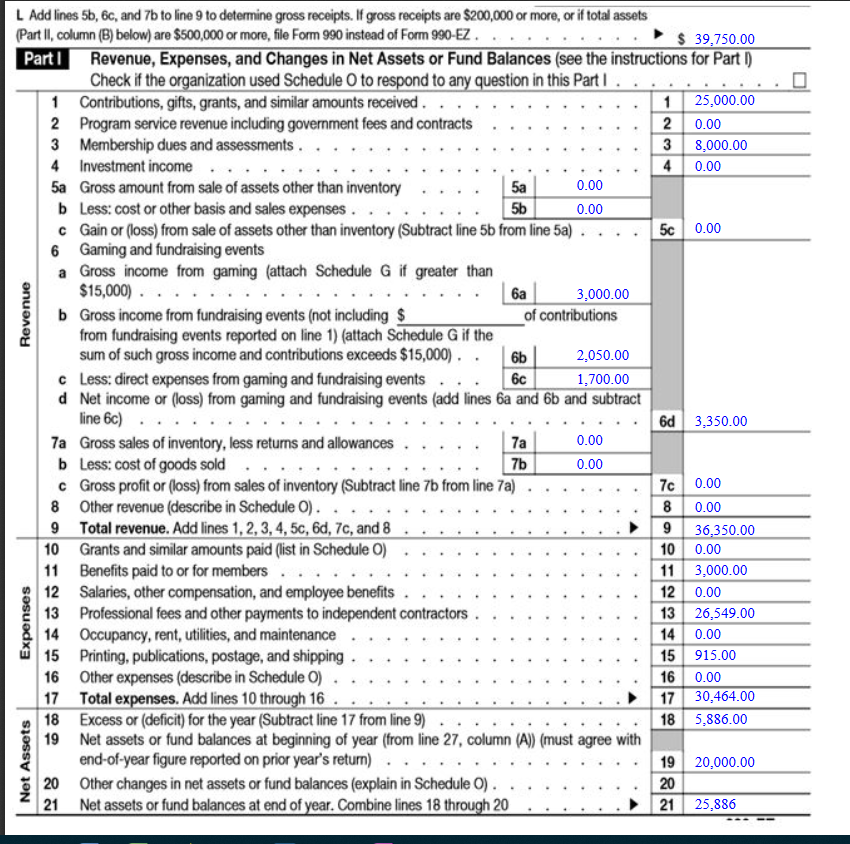

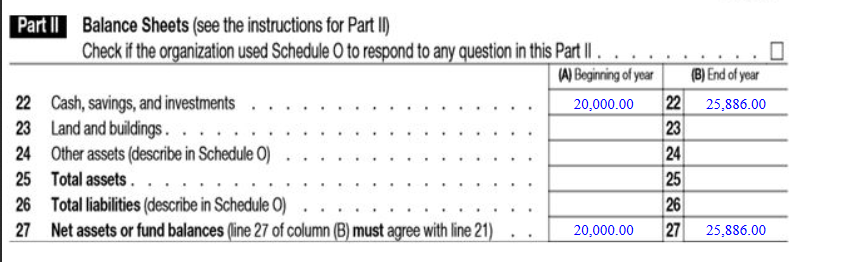

The 990EZ form consists of various sections and lines that capture key financial data, including revenue, expenses, assets, liabilities, and program activities. It also requires disclosure of information about the organization’s governance structure, key personnel, and other relevant details.

By accurately completing and filing the 990EZ form, organizations demonstrate transparency and accountability to the Internal Revenue Service (IRS) and the public. This form plays a crucial role in maintaining the organization’s tax-exempt status and providing important financial information to stakeholders.

It is important for organizations to understand the requirements and instructions associated with the 990EZ form, as well as to ensure proper documentation and record-keeping to support the reported financial data.

To access the 990EZ Form in the Finance section, simply click on the 990EZ option. This will bring up the 990EZ Form, displaying the various line amounts as per the official form. It is important to note that in order for the amounts to accurately reflect on Line 21, they need to match Line 27B. If it does not that means all your Account Categories which have transactions are not associated with the 990EZ Line codes.

To ensure this alignment, it is necessary to associate the appropriate 990EZ codes to the respective accounts in your Chart of Accounts. By correctly associating the codes, you can ensure that all account categories with transactions are properly linked to the corresponding 990EZ line codes.

Maintaining this association between account categories and 990EZ line codes is crucial for accurate reporting and compliance.